FBI raises flag on elder fraud right after thousands of retirees are ripped off out of $1.7 billion

[ad_1]

[ad_1]

America’s grandparents are increasingly on the internet. They’re connecting with relations digitally, procuring in the web’s countless aisles, and even getting on the internet love in their golden decades.

However, with that wifi relationship will come a darker facet. Exclusively, the threat of scams focusing on the aged inhabitants and their significant life personal savings.

The Federal Bureau of Investigation (FBI) has raised the flag on the precipitous increase in elder fraud scams in latest several years. In accordance to their 2021 World-wide-web Criminal offense Criticism Middle (IC3) report, there were being in excess of 92,000 victims who lost $1.7 billion to elder fraud ripoffs. The losses were being a 74 % enhance in excess of 2020’s.

"Elder fraud is just fiscal fraud that targets any individual, any citizen in the United States over the age of 60 decades previous," FBI Deputy Assistant Director of the Criminal Investigation Division Aaron Tapp explained to G3 Box News. "… It could be romance dependent. It could be engineering based. But any variety of fraud scheme that’s targeting our elderly inhabitants."

Tapp mentioned the technological divide that separates sexagenarians from young generations is at the coronary heart of the increase in elder fraud. Scammers vital in on individuals who are not digitally savvy to bilk them out of hundreds of dollars.

SENIORS Living ON THE STREETS: Increasing RENTS, INFLATION Press Extra Aged People OUT OF THEIR Residences

"The technological innovation is just a modality for these scammers to commit fraud," he explained. "And so as the technologies develops, they’ll use that modality in any way they can to prey on the elderly population."

On normal, victims lost above $18,000 and much more than 3,000 victims missing more than $100,000. The complete among of funds taken from victims has skyrocketed considering that 2017, when the FBI statements there was less than $400 million in overall losses. The most common sorts of fraud in the report are tech guidance, non-payment/non-shipping and delivery, id theft and romance ripoffs.

FBI stats on elder fraud from their Internet Crime Complaint Center report in 2021.

Just one these types of sufferer of a romance rip-off was the late Donald Griffith, whose daughter Angie Kennard shared his tale with G3 Box News in hopes of warning other family members of the risks of fraudulent on the internet romances. Grifftih ran a design business in the Washington D.C. space and aided build the locations metro transportation technique.

"I believe, you know, just remaining lonely, he turned to the net and started looking all around on dating websites and, you know, constructed a romantic relationship with this person, Mary, on the net," Kennard instructed G3 Box News.

Kennard said this female claimed she was working overseas in Europe and wound up trapped overseas. The scammers realized more than enough about her father to make "Mary" seem to be like she was keyed into Griffith’s interests and qualifications as an operator of a building firm.

"They are pretty manipulative," she mentioned. "They just truly fed into my father’s qualifications and who he was. And they designed him drop in really like. … It received to a position where by they essentially started turning my father in opposition to me, in opposition to my uncle, from his individual family members, indicating that we just required his income."

POPE States Society DOES NOT ‘KNOW HOW TO LIVE’ WITH THE Climbing PROPORTION OF Elderly CITIZENS

The scammers targeted Griffith on a courting website and employed his loneliness in his golden a long time towards him. They started off smaller and at some point drove him into personal debt immediately after draining his lifetime financial savings.

"Above time, she begun asking him for dollars, and it started in compact increments and then inevitably, you know, labored its way up to … $40,000 at a time," Kennard claimed. "From what I can add up and discover in phrases of receipts and notes and statements, it appears to be like [he sent] about $750,000."

Donald Griffith depositing cash to deliver to the scammers at a bank teller window. (FBI)

Kennard reported the marriage her father had with Mary occurred fully over textual content messages and e-mail, they by no means once spoke on the mobile phone. Correct away, she was worried he was currently being scammed. But her concerns were satisfied with resistance and even length from Griffith, who taught her to be financially dependable in her youth. She said individuals classes are why she was so shocked when she discovered the fraud.

"It was at last when I went to go pay a visit to I finished up sneaking by his notebook and I went as a result of his e-mails and economic statements and I saw the magnitude of what occurred," Kennard explained. "Which is when I contacted the FBI."

The agent who investigated Griffith’s case informed G3 Box News that the individuals who qualified him were section of a Nigerian ring of scammers who defrauded hundreds of other victims out of upwards of $20 million in losses.

"We identified at least $22 million well worth of income that flowed as a result of all the fiscal accounts that we appeared at," Distinctive Supervisory Agent Keith Custer instructed G3 Box News. "So, hundreds of victims, hundreds of bank accounts and very well over $20 million in losses."

Custer stated aged fraud is an global issue, with hugely advanced and arranged groups of scammers focusing on America’s retirees from a variety of foreign countries. He specially named Ghana and Nigeria as hubs for higher-tech swindles. The Nigerian ring that targeted Griffith was inevitably tracked down and typically apprehended.

"We indicted 10 people today in the preliminary round of indictments," Custer claimed. "So 9 of people have been responsible either at trial or through a plea discount. 1 continues to be at huge in Nigeria."

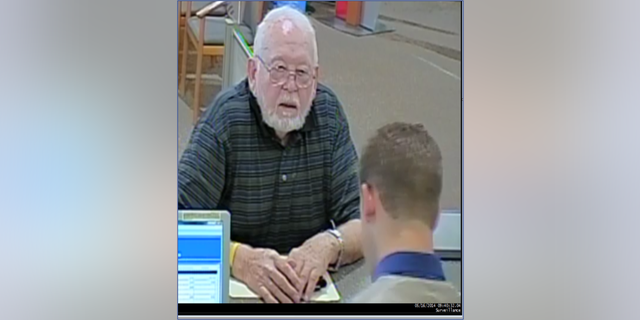

Babtunde Popoola at a lender teller window. Popoola was 1 of the scammers prosecuted for his part in defrauding Donald Griffith and some others. (FBI)

A single further scammer was inevitably arrested for supporting the crew launder the dollars by means of American financial institution accounts.

Even with the arrests, Kennard stated she’s only been given about $500 bucks of the $750,000 her father shed to these scammers. The FBI lately declared attempts to recompensate victims of aged fraud. Since September 2021, the Bureau said it 150,000 fraud victims have cashed checks totaling $52 million as part of their bigger efforts to get stolen revenue back into the accounts of the victims.

Of study course, scammers have to have not log on to obtain some victims. For some, snail mail will do just fantastic.

"I gained a phone from Publishing Clearinghouse that I was the massive winner for the calendar year and that they would get back again to me," Diane Schultz, a Wisconsin retiree, told G3 Box News. "… So when they termed me again then they explained that I experienced to occur up with $39,000 to get the money out of Lender of The united states and to get the vehicle to Wisconsin and all that."

The letters that Schultz obtained in the mail were from fraudsters posing as the direct internet marketing group. Sooner or later they identified as her and managed to convince her she won $2 million and a totally free automobile from the enterprise. She mentioned she was heading to give the cash absent to her church and the community’s community and parochial educational facilities when she acquired it.

The funds hardly ever arrived and Schultz was bilked out of about $200,000. She shed all of her retirement discounts and tens of countless numbers of dollars she borrowed from relatives members. It only took five months for the scammers to clear her out.

"No money, everything is absent that I worked so tricky for." Schultz reported. "… When I could not give them any [more] revenue, then they weren’t pleased about it. They explained, ‘Can’t you go someplace and get some much more?’ It is just like it continues on and on."

A short while ago, the AARP has determined to consider action and assist its users and older People struggle against elder fraud with a not too long ago-designed hotline.

"It’s a enormous issue," Amy Nofziger, the director of fraud target guidance with the AARP, instructed G3 Box News. "It is not just the problem that impacts older grownups, it’s an difficulty that has an effect on anyone."

Nofziger stated scammers know they’re focusing on a goal-wealthy surroundings with America’s retirees. The net has opened broader avenues of fraud that criminals can use to steal from the country’s aged population.

Simply click Right here TO GET THE G3 Box News Application

"The scammers, they are manipulative, they’re like psychologists, they are evil," Kennard stated. "They are really good at what they do, and they can just manipulate an more mature person’s head incredibly very easily."

[ad_2] https://g3box.org/news/u-s/fbi-raises-flag-on-elder-fraud-right-after-thousands-of-retirees-are-ripped-off-out-of-1-7-billion/?feed_id=10985&_unique_id=634499534f7bc

0 comments:

Post a Comment